What Payment Processor Does Shopify Use? Here’s the Real Deal

Introduction

If you’re running a Shopify store (or planning to), there’s one thing you can’t afford to mess up—your payment processor. It’s what makes the money move, and trust me, if you pick the wrong one, it can slow down sales, cut into your profits, and even cause account issues.

So, what payment processor does Shopify use?

The default option is Shopify Payments—but that’s not your only choice. A lot of people don’t even realize there are tons of other payment gateways you can use, depending on your business, location, and transaction needs. Some people stick to Shopify Payments, some prefer PayPal, and others go for Stripe or even Amazon Pay.

But which one is right for you? And what are the hidden fees, rules, and benefits that no one really talks about? Let’s get into it.

The Basics: Shopify Payments vs. Third-Party Gateways

What is Shopify Payments?

Shopify Payments is Shopify’s own built-in payment processor. It’s basically their way of making sure you don’t have to set up a third-party system—everything is handled inside Shopify.

Why Do People Use It?

- No extra transaction fees – Unlike third-party payment processors, Shopify Payments doesn’t charge an extra 1-2% per sale on top of normal processing fees.

- Faster payouts – Your money usually arrives in 1-3 business days, instead of getting stuck in PayPal for a week.

- No annoying redirects – Customers stay on your site, which reduces abandoned carts.

- Multi-currency support – Essential if you’re selling globally.

But here’s the catch—it’s not available everywhere. If you live in India, Mexico, or most of Africa, you’re out of luck. That’s where third-party payment gateways come in.

What If You Don’t Want to Use Shopify Payments?

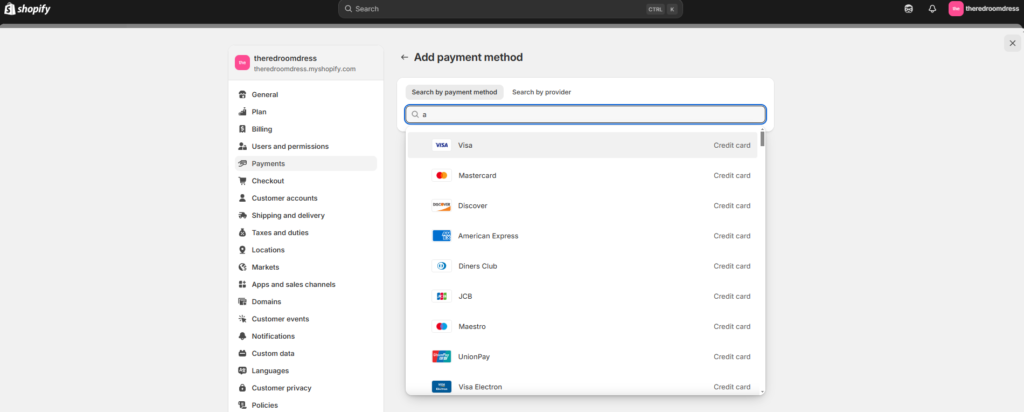

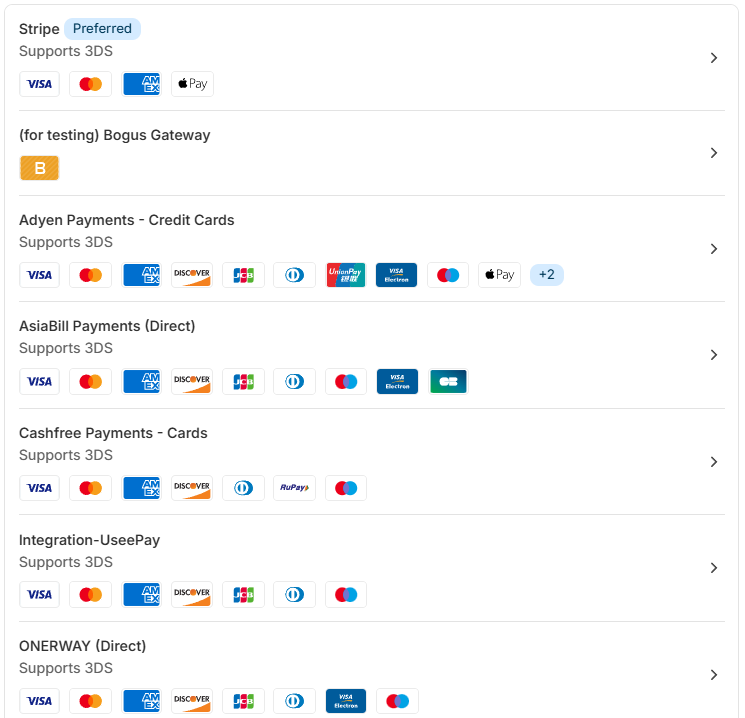

If Shopify Payments isn’t an option in your country or if you prefer a different setup, you can integrate a third-party payment processor instead.

Popular Alternatives

✔ PayPal – One of the biggest names in online payments. Most customers trust it.

✔ Stripe – A direct competitor to Shopify Payments, known for customization options.

✔ Authorize.net – Used by larger businesses that need advanced fraud protection.

✔ Amazon Pay – If your audience shops on Amazon, this can be a great choice.

The downside? Shopify charges extra fees if you use a third-party processor—anywhere from 0.5% to 2% per sale, depending on your plan.

FAQs: Everything You Need to Know About Shopify Payment Processing

1. Can I use Shopify without Shopify Payments?

Yes, but you’ll pay extra transaction fees if you go with PayPal, Stripe, or any other third-party gateway.

2. What countries support Shopify Payments?

As of now, it’s available in the U.S., Canada, the U.K., Australia, and most of Europe.

3. How long does it take to get paid with Shopify Payments?

Usually 1-3 business days, depending on your bank.

4. What are the transaction fees?

- Basic Shopify: 2.9% + 30¢ per transaction

- Shopify Plan: 2.6% + 30¢ per transaction

- Advanced Shopify: 2.4% + 30¢ per transaction

- Third-party processors: +1% to 2% additional fees

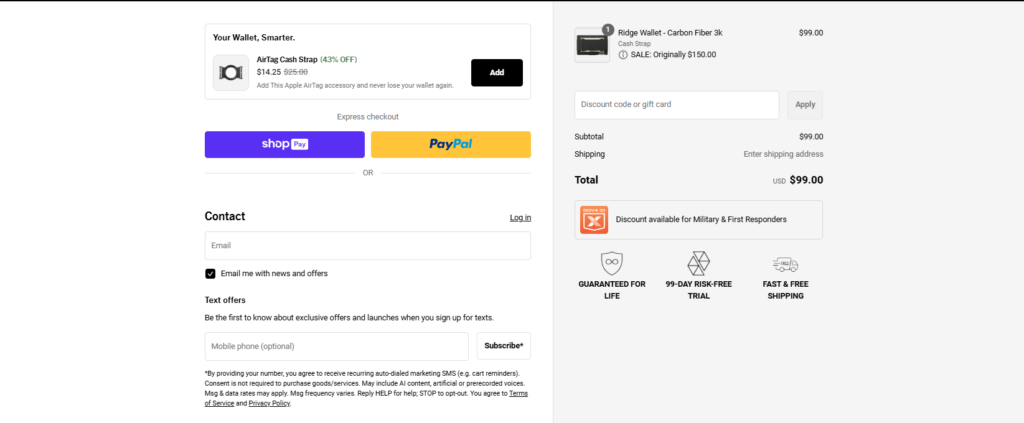

5. Can I use PayPal and Shopify Payments together?

Yes. Shopify lets you enable multiple payment options. Customers can choose their preferred method at checkout.

6. What happens if Shopify Payments flags my account?

Your payouts might get delayed or frozen if Shopify detects “unusual activity.” This is common with high-risk industries.

7. How can I lower my processing fees?

- Use Shopify Payments (avoids the extra Shopify fee)

- Upgrade to a higher Shopify plan (lower per-transaction fees)

- Encourage bank transfers or manual payments (if possible)

8. Can I accept cryptocurrency payments?

Not through Shopify Payments. But you can integrate Coinbase Commerce or BitPay if you want to accept crypto.

How Payment Processing Affects Your Shopify Store’s Success

A lot of people don’t realize this, but your payment processor isn’t just about getting paid—it actually impacts your conversion rates, customer trust, and user experience.

1. Make Checkout as Easy as Possible

Ever clicked “buy now” and then saw a sketchy-looking checkout page? Yeah, most people just close the tab. A confusing or slow checkout page kills sales.

- Keep everything fast & seamless

- Offer multiple payment options (some people hate PayPal, some love it)

- Make sure it looks trustworthy (SSL certificates, security badges, etc.)

2. Improve Checkout Design with Prebuilt Shopify Sections

A well-designed checkout boosts conversions. Instead of building everything from scratch, you can use Prebuilt Shopify Sections to quickly add optimized, high-converting checkout elements to your store.

3. Optimize for Search Engines

If you want higher Google rankings, your payment setup matters. A slow, clunky checkout process can increase bounce rates, which hurts SEO. If you’re trying to rank for Shopify-related keywords, check out our Shopify SEO in Bradford Guide

Final Thoughts: Which Payment Processor Should You Use?

At the end of the day, Shopify Payments is the easiest option for most store owners—but it’s not your only choice.

If you want lower fees and faster payouts, stick with Shopify Payments. If you need advanced features or Shopify Payments isn’t available in your country, then Stripe, PayPal, or Authorize.net might be better.

Just don’t ignore this decision—it directly impacts your profits, customer experience, and long-term success.